Despite their best efforts to meet the expectations of their customers, companies can still struggle to retain their market share. One reason, as illustrated by the Kano model, is that product or service qualities that were once simply attractive can turn into must-be qualities. If companies do not keep up with new expectations, the result can be a loss of excitement and customer attrition. The solution: Organizations must listen to the voice of the customer (VOC) to find what products or service elements continually surprise and delight the customer.

To discover these qualities, practitioners typically employ VOC analysis methods, such as brainstorming, cross-industry benchmarking and customer research. In some cases, however, it is logistically difficult to capture the input of individual customers because of the high customer volume. A research method known as scenario planning – which involves identifying deterrents to customers meeting their goals and ways to help customers achieve those goals – can result in insightful information.

Preparing for Scenario Planning

To begin a scenario planning session, organizations should invite employees from various functions – such as customer research, marketing, quality and IT architecture – to participate in the process. The sessions, which ideally should last about three hours each, work best if they are scheduled in an isolated location so that the team is not distracted. The number of sessions depends on the complexity of the scenarios, so teams should be committed to spending the time and effort necessary to match the situation.

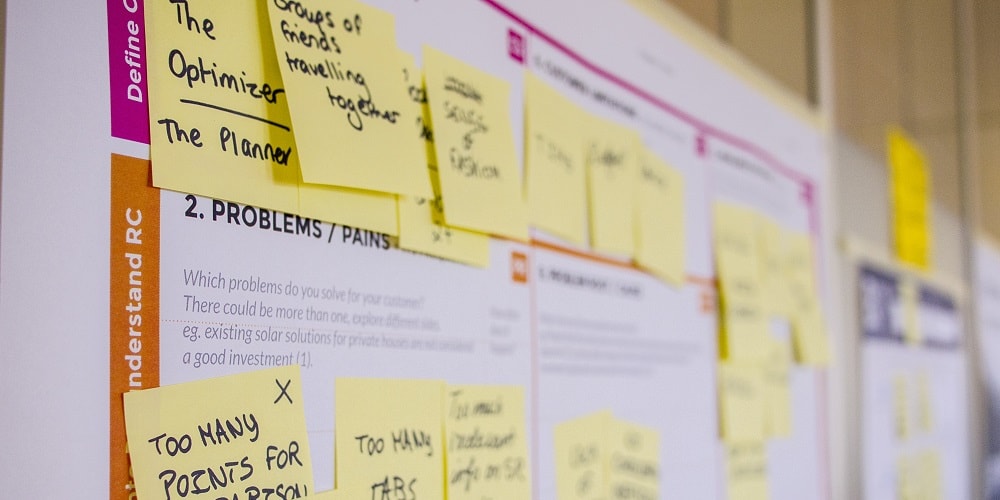

A senior customer research executive is often appointed as the facilitator for the sessions, but facilitation can be rotated to ensure that one person is not overburdened and that there is active participation from other members. During the sessions, input given by the participants should be made visible to everyone. There should be at a minimum a whiteboard, sticky notes and flip charts available to encourage active participation among group members.

Financial Savings Example

For an example of a typical scenario-planning process, say a financial services organization has decided to introduce a breakthrough offering to keep the firm’s growth momentum high and retain the market share. The company’s VOC analysis included regular customer pulse-check surveys and a dedicated team to manage the data collected. Through the pulse-check surveys, the team determined that customers had expressed concern about their inability to achieve personal financial goals. Because it was not feasible for them to go back to the customers to probe further, the team decided to use scenario planning to address this issue.

In this example, some of the financial goals of customers that the team discussed were saving for retirement, purchasing insurance policies, buying a new car or house, or planning for a vacation. As the scenario-planning session began, the team brainstormed the scenarios a customer could encounter that would result in failure to achieve these personal financial goals.

The team then looked into each scenario and brainstormed on how they could create a delighting future for the customer. In other words: What can customers expect ideally from the organization in each scenario so that they can achieve their goals? For instance, if the scenario is: “saving for buying a new car,” customers would like to see:

- Where they are with respect to their set milestones.

- What they should do to meet the goals (advice from the financial organization).

- How their other financial goals are impacted should they agree to these suggested actions.

As a next step, the team identified various means to make these goals happen. A periodic notification system was established through an online banking system so customers could track the status of each goal. A dashboard also was made available to display the status of all parameters through customer home pages on the bank’s website.

Because these scenario-planning sessions were conducted without involving customers, there was a risk of having a mismatch of expectations in the real world. To address this problem, the team selected a sizable sample of internal employees and shared the potential solution with them. The employees were requested to “be the customer” while assessing the proposed solution.

After some fine-tuning of the bank’s offering, based on the feedback from the pseudo-customers, the financial goals management product that was finally offered to the end customers was well appreciated. By conducting this test run and exploring all possible scenarios the team could envision, the bank was able to improve its customer retention and acquisition.